By Theresa Martelino-Reyes, VERA Files

A state-owned Chinese oil firm has rejected the proposal of business tycoon Manuel V. Pangilinan to invest in a contract to drill in the disputed Reed Bank but welcomed “innovative” proposals on how it can participate, according to a memorandum Pangilinan submitted to President Benigno Aquino.

State-owned China National Offshore Oil Corp. (CNOOC) turned down the offer made by Pangilinan, chairman and chief executive officer of Philex Petroleum Corp, in a meeting on May 2, 2012.

“A Farm-In Agreement into SC 72 (which Philex previously suggested to them) is not acceptable given the sovereignty issue,” Pangilinan reported to Aquino in an aide memoire submitted to the President on May 7, 2012. The contents of the aide memoire, obtained by VERA Files, have not been made public since it was submitted to the President.

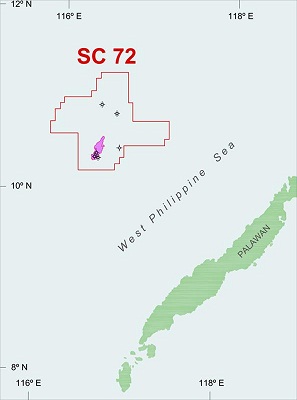

SC 72 refers to Service Contract 72, signed in 2010, in which the Philippine government awarded Forum Energy Plc. (FEP) exploration rights to a basin within Reed Bank. Philex owns 64.45 percent of FEP, a London-based listed oil and gas exploration firm focused on the Philippines. FEP in turn owns 70 percent of SC 72.

A farm-in agreement is a contract signed between the owner of the “farm” and its exploration partner. Accepting such an arrangement could be interpreted as CNOOC accepting the Philippines as “owner” of Reed Bank.

Reed Bank, also known as Recto Bank, is an islet being claimed by the Philippines, Vietnam, Taiwan and China, which calls it Liyue Tan.

To the Phlippines, Reed Bank is part of Palawan, being about 85 nautical miles west of Puerto Princesa and within the country’s 200 nautical mile Exclusive Economic Zone. It falls within the area defined by the United Nations Convention on the Law of the Sea (UNCLOS) as part of the territory of a coastal state which has the sovereign right to explore, exploit, conserve and manage the natural resources found there.

Reed Bank is about 800 nautical miles from mainland China but is included in its controversial 9-dash line map covering almost the entire South China Sea.

Last week, Pangilinan confirmed that his office in Hong Kong, where the headquarters of First Pacific Co. Ltd. is located, was coordinating with CNOOC to set a date to continue discussions on Philex’s offer to explore for oil and natural gas in the Reed Bank.

Regarding the planned meeting, Philex president and chief operating officer Carlo Pablo said, “Nothing (is) scheduled yet.” If it pushes through, this would be at least the third known Philex-CNOOC meeting after the second one held in Hongkong last year.

In the May 2012 aide memoire, Pangilinan said Yang made it clear that “the Chinese government has granted CNOOC exploration rights over an area which includes SC72.”

Pangilinan said Yang summarized the discussion under three points. First, Sovereignty remains fundamental and neither CNOOC nor Philex is competent to address this issue. Still, CNOOC saw no obstacle to commercial and technical cooperation between the companies, provided both the Philippine and Chinese governments agree that both companies can work together to explore the resource potential of the area of mutual interest, while allowing any question over sovereignty to be resolved as a separate matter on a Government-to-Government basis.

Second, both companies are open to studying all innovative proposals to be able to move forward.

Third, both companies agree that the early involvement of CNOOC would be helpful in defining the resource potential of the area of mutual interest (including participation of CNOOC in FEP’s/ Philex’s work program).

SC 72 provides for a seven-year exploration period extendable by three years, and a 25-year production period can be extended by another 15 years.

FEP began exploration activities under SC 72 in 2011 with $10 million sourced from Philex Mining Corp., its mother firm which owns 64 percent of Philex Petroleum. All drilling activities, however, were stopped following an incident in the Reed Bank on March 2, 2011 when Chinese vessels approached FEP’s ship demanding that it stop all activities and leave the area.

This prompted the Philippine military to send planes and Coast Guard ships to the area and forced FEP to cancel a planned a geotechnical survey of the sea floor seven months later.

The Department of Energy has estimated that the entire Reed Bank has 1.035 million hectares of potential gas field containing oil, gas, and condensates worth some $23.2 billion.

According to 2012 estimates of the United States Energy Information Administration, about one-fifth of the 12 billion barrels of oil and 160 TCF of gas in the western portion of the South China Sea are found in contested areas, particularly the Reed Bank.

It warned, however, that “these additional resources are not considered commercial reserves at this time; extracting them may not be economically feasible.”

Pablo, an engineer with almost 30 years of experience in the mining and oil industries, has pointed out that the only way to determine the commercial viability of SC 72 is by drilling wells. He likened a seismic survey to an ultrasound which provides only an indication of what may possibly lie beneath the water.

Earlier media reports said Pangilinan brought CNOOC into the Reed Bank project to address the problem of the security posed by China.

(To be concluded.)

(VERA Files is put out by veteran journalists taking a deeper look at current issues. Vera is Latin for “true.”)

Very interesting information, thanks. I’m wondering why the Philippines does not step in with the added investment money under a public/private agreement. For sure, the Navy will have to be standing by when the first test wells are sunk.

China doesn’t need MVP or any Filipino investor. China is cautious about the legal implications and her claim to the disputed territories. Also, China has more than enough money to invest on her own.

All the problem we are encountering with China re : West Philippine Sea (South China Sea) is a result of the JMSU – Joint Marine Seismic Undertaking signed by the corrupt Pandak now in Veteran’s Hospital !!. We allowed the Chinese to see the potential riches hidden under our continental shelf !! Hay naku nakakakulo ng dugo !!

#3 Indeed, the midget left lots of trash at this administration that may take decades to clean up. In the meantime, she’s comfortably resting at the hospital now without a neck brace.

#3. mr. romyman, i vehemently oppose your accusation that my family and i were included with those who allowed the chinese to intrude and see the riches under the philippine continental shelf lying within the west philippine sea. since day one of the goyang’s grabbed leadership, we already were against her unconstitional take over of the government from the duly mandated leader, herap he-ercito hestrada.

you can read my posts since i gate-crashed the bahay ni ate.