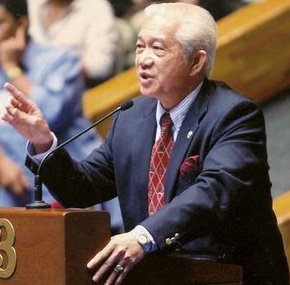

Last Monday, Sen. Ralph Recto resigned as chair of the Senate Ways and Means committee after he found himself a target of criticisms for his committee report and his own version of the Sin Tax bill which groups pushing for higher taxes say is Philip Morris-friendly.

December last year, Batangas Rep. (2nd district) Hermilando Mandanas, a member of the Liberal party just like Recto, was removed as chairman of the ways and means committee. He was replaced by another LP member, Davao City Rep. Isidro Ungab.

The Ways and Means committees are most coveted and are given to senior legislators. The committees have jurisdiction on all matters relating to revenue which include taxes and fees, tariffs, loans and other

sources and forms of revenue.

I know of a legislator who had held that position for many years he became so rich that last election, money flowed like water in his province. He won, of course, together with his son who also ran for another elective post.