By Ellen Tordesillas, VERA Files

Ombudsman Conchita Carpio-Morales has asked the Anti-Money Laundering Council for a copy of the records of impeached Chief Justice Renato Corona’s bank deposits, including dollar accounts that are the subject of a temporary restraining order issued by the Supreme Court.

A highly placed source in the Office of the Ombudsman confirmed that Carpio-Morales sent the request after her office received a complaint seeking an investigation on Corona’s supposed ill-gotten wealth and possible money laundering. But AMLC Executive Director Vicente Aquino said he was not aware of such a letter in his office. “We have not received such request,” he said.

Aquino also said he refuses to talk about Corona’s assets in the media, calling it a “sensitive” issue.

The Anti-Money Laundering Council is composed of the governor of the Bangko Sentral ng Pilipinas, the Insurance Commissioner and the Securities and Exchange Commission chairperson.

Carpio-Morales’ request was precipitated by the complaint filed on Feb. 17 by a group of individuals that included former Akbayan Rep. Risa Hontiveros-Baraquel asking the Ombudsman to probe Corona’s possible illegal accumulation of wealth, a violation of Republic Act 3019, the Anti-Graft and Corrupt Practices Act.

The group also asked that Corona be investigated for possible violation of RA 9160, the Anti-Money Laundering Act. The other complainants are Harvey Keh of Kaya Natin, Ruperto Aleroza of the Pambansang Katipunan ng mga Samahan sa Kanayunan (PKSK), Albert Concepcion of People’s Union for Social Obligation (PUSO) and Gibby Gorres of the Student Council Alliance of the Philippines (SCAP).

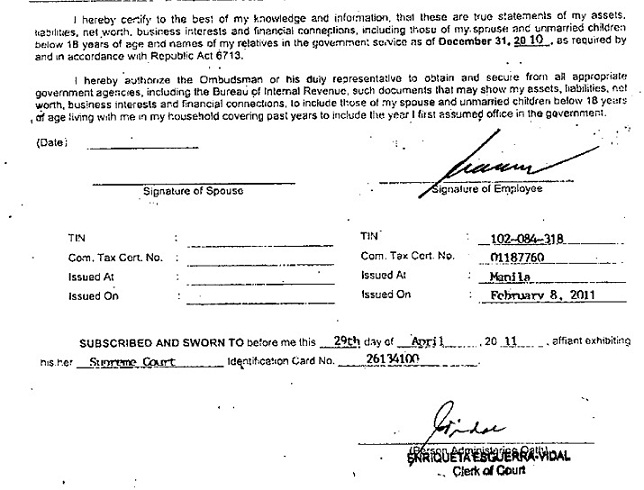

A paragraph at the bottom of the Statement of Assets, Liabilities and Networth (SALN) form serves as a waiver that, when signed by government officials and employees including Corona, empowers the Ombudsman to access from government agencies relevant records needed to examine their networth declarations.

The waiver reads, “I hereby authorize the Ombudsman or his duly representative to obtain and secure from all appropriate government agencies, including the Bureau of Internal Revenue, such documents that may show my assets, liabilities, networth, business interests and financial connections, to include those of my spouse and unmarried children below 18 years of age living with me in my household covering past years, to include the year I first assumed office in the government.”

On March 6, the Senate, sitting as an impeachment court, decided to admit Corona’s bank records, including his dollar deposits, as evidence despite suspicions that the prosecution had gotten them through illegal means.

The prosecution has presented to the Senate 10 accounts the Chief Justice had opened with the Philippine Savings Bank’s Katipunan branch, five of them dollar accounts, to substantiate Article 2 of the impeachment complaint. Article 2 charges that Corona failed to make public his SALN, omitted to include a number of properties from his declarations, and might have accumulated ill-gotten wealth, including “keeping bank accounts with huge deposits.”

One of the dollar accounts reportedly showed an initial deposit of $700,000. Sources, however, said the sum of the dollar deposits was “mindboggling.”

Corona has said in media interviews that he was willing to open his dollar accounts “in due time.” His lead counsel Serafin Cuevas told the Senate on Wednesday, “I have not yet concretely and positively arrived at the ultimate conclusion that we have to or we do not have to. That will depend on the progress of the proceedings in the nature of our evidence or the stages at which our evidence may be.”

The Supreme Court, voting 8-5, granted on Feb. 9 PSBank’s petition to issue a TRO on the Senate subpoena for the bank to submit records of Corona’s dollar deposits, citing the law on foreign currency deposits (RA 6426) that classifies foreign currency deposits as “absolutely confidential.”

“(E)xcept upon the written permission of the depositor, in no instance shall foreign currency deposits be examined, inquired or looked into by any person, government official, bureau or office whether judicial or administrative or legislative, or any other entity whether public or private,” states RA 6426.

In his dissenting opinion, however, Associate Justice Antonio Carpio said the guarantee of secrecy under the foreign currency law applies to nonresidents to encourage the inflow of foreign currency deposits into the country.

He said the TRO makes a mockery of all existing laws designed to ensure transparency and good governance in public service as it will encourage government officials and employees to hide their true wealth under a foreign currency bank account.

The Supreme Court en banc is expected to decide on PSBank’s petition on Tuesday before it goes on a break.

Signed in 2001, the Anti-Money Laundering Act or RA 9160 defines money laundering as a crime whereby the proceeds of an unlawful activity are transacted or attempted to be transacted to make them appear to have originated from legitimate sources.

The law requires banks and similar institutions to report to the AMLC within five working days any transaction that exceeds P500,000 within one banking day, called a “covered transaction,” and “suspicious transactions.”

A transaction, regardless of the amount, can be considered “suspicions” for the following reasons:

• There is no underlying legal or trade obligation, purpose or economic justification.

• The client is not properly identified.

• The amount involved is not commensurate with the business or financial capacity of the client.

• It may be perceived that the client’s transaction is structured in order to avoid being the subject of reporting requirements under the AMLA.

• Any circumstance relating to the transaction which is observed to deviate from the profile of the client and/or the client’s past transactions with the covered institution.

• The transaction is in any way related to an unlawful activity or any money laundering activity or offense under this act that is about to be, is being or has been committed.

When he took the witness stand last month, PSBank President Pascual Garcia III said a Bangko Sentral ng Pilipinas examiner told the bank to put the notation “PEP” on Corona’s records.

Under AMLC rules, elected and appointed public officials are considered “politically exposed persons” or PEP. – with Yvonne T. Chua

(VERA Files is put out by veteran journalists taking a deeper look at current issues. Vera is Latin for “true.”)

nakakalungkot na ung inaakala mong magbibigay ng karapatdapat na hustisya, sya pa ang nagtwi-twist nito para pumabor sa kanila…

lalo lang pinalalakas ang “betrayal of public trust” na issue against the CJ, eto ba ang klase ng taong pagtitiwalaan mo na maging fair sa pagbibigay ng justice?

teka, wala akong kinalaman diyan, ha?

kung ating susukatin ang haba ng mga pinipilit ituwid ng kampo ni corona, baka mas malayo pa ang talsik ng laway kapag idinura.

pagkahabahaba man daw ng binuhol na sinulid, sa butas din ng karayom ang bagsak!

“……Corona has said in media interviews that he was willing to open his dollar accounts “in due time.”…….”

long overdue na, ah!

hanggang kailan ba ‘yan corona, ha?

Totoo nga, inilabas na ni Corona ang lahat-lahat.

http://goo.gl/sN2Xn

The AMLA rule in fact delayed by a full day, a cash withdrawal with my bank.

I would not have undergone angioplasty if I had delayed further a cash transfer from my New York stockbroker. My broker had to be personally interviewed by my local bank manager by phone before the cash was released to me. Being my personal broker for years, he felt it an extreme emergency he had to advance the money out of his own funds instead of through the investment bank where he worked.

That prompted an alarm with AMLA being over and above the P500K threshold. Corona is definitely aware of such SOPs with large cash movements He knows his transactions over the threshold are being monitored by government.

Or he is just plain stupid.

#4, Ha! Ha! Ha!

Ikaw talaga, Tongue.

Sabi nga ng mga tao dito sa bahay, sira-ulo daw ako, tumatawa ng mag-isa. Hanggang ngayon natatawa pa ako. Hahaha.

Hah,hah,hah…ano ba yan!

If ever Corona will be able to wiggle his way through the senate impeachment court, wala naman siyang lusot kay Ombudsman and sa BIR. Either way, tiklo pa rin siya!

Marunong si Corona ng lahat ng “legal” games. I doubt so much Tongue if he went beyond the limit of withdrawals. Marunong nga siyang mag-withdraw ng pera niya sa bangko bago mag-year end para nga naman wala ng balance kung ma-aaudit siya. Marunong din siyang bumili ng mga properties niya na nakapangalan sa mga kamag-anak niya para hindi halata na marami siyang mga assets. Most of all, sa dollar account siya nagtago ng marami coz he knows that the dollar accounts are sacred. Mahirap mabuksan.

“I doubt so much Tongue if he went beyond the limit of withdrawals.”—parasabayan

Hindi na po siguro kailangan, baka ayaw na, at baka menopause na si misis, :).

Beyond the limit? The December 2011 withdrawal was for P32 Million! However you divide it in less than P500,000 per day withdrawals to avoid the AMLA alarm, he would have started withdrawing from Dec. 14 and henceforth not counting the two legal holidays (Xmas and Rizal Day) and any other special holidays. My banker-friends tell me PSBank was complicit in this case.

He knows all eyes were on him but he was too arrogant he chose to game the system flaunting his mighty control over the judiciary when it was needed.

Di ba pwedeng mag withdraw ng 499K each time and do it several times in a day? I really do not know your bank policies there. In the US, kahit na magkano ang pera mo sa bangko, kung cash withdrawals, may limit per day. But if you transfer electronically, kahit na magkano, pwede.

499.99999K, is the CUMULATIVE maximum for which you evade AMLA reporting PER DAY, regardless if if was undertaken through different banks.

If I were to withdraw that amount below P500K from someone’s account, it’s immediately obtainable. Once it’s beyond P500K

it is flagged and the standard procedure in reporting commences. What’s more, it’s a no-go until the depositor confirms it.

Remember that each time Corona moves a big sum, he sends Cristina to PSBank with his authorization. It only expedites the release of the money but it is still subject to AMLA recording.

#4. Tongue, ano ba ‘yung inilabas ni corona?

bakit ba sila tawa nang tawa doon sa ipinakita mo?

may balot pa ba?

o, nakaturo na lang sa lupa?

pasensiya na dahil hindi pumayag ‘yung bantay ko dine na makapanilip ako, eh.

I am under the weather, mas sumakit pa ulo ko sa link mo Tongue #4 dahil sa pigil na tawa. 🙂

Sorry, Magno. Baka hatawin ka nga ng mga Mutawa ba yun? Dalawang musmos na parehong walang salawal, hawak nung isa yung patotoy nung isa, yung isa ganoon din sa kanya. Mukha ni Corona at Toby yung mga bata. LoL. Lobo ang ilong ko sa sipon.

eh, sino na talaga sa dalawa ang ano?

paano ba hawak?

kung magkukuwento ka kasi, kumpletuhin mo na.

nakaturo pa ba sa langit o naka-good morning titser na si corona?

Mga batang paslit nga e. Na Photoshop yung mukha nina Tiangco at Corona sa litratong na nakahawak sa etits nung kabila; yung kabila ganun din. Naku bakit kelangan mo ang malaman kung saan nakaturo. hahaha.

Ellen, do you remember the email to Karen L.? I mentioned there about Burgundy which I suspect to be either a dummy corp. for GMA or a crony company since there were seven Service Contracts for oil exploration awarded by Reyes but all the 7 companies had only one and the same president – Rogelio Serafica?

This is the same Burgundy that owns the QC condo units of Corona and the 3 inclusive parking lots. Merong konek sa conjugal thieves.

tongue, kasi, kung nakaturo pa sa langit, papaglaruan ko sa mga alaga ko dineng itik ng pasyutan ng lastik at kung nakagud morning sitser na eh ipapagawa kong target.

Ms Ellen, what a good foresight. Nakuha nyo agad months ago na game ender ung sa issue ng AMLC. Good source!