If you have not yet signed the manifesto for HB 5727, it’s time you take a look at it.

If you have not yet signed the manifesto for HB 5727, it’s time you take a look at it.

There’s one in Facebook: http://www.facebook.com/note.php?note_id=260011474082380

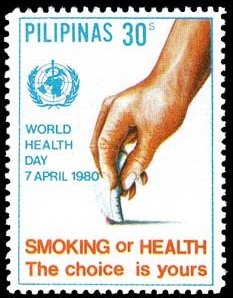

HB 5727, authored by Cavite Rep. Joseph Emilio Abaya, calls for the restructuring of the excise tax on alcohol and tobacco products. The rationale is that, if prices for what we refer to as sin products were to be increased, it would become less affordable to many people, especially the poor. They would then be saved from the ill effects of alcohol and cigarettes. We would then become a healthier nation.

The manifesto explains the financial advantage to the government and to the Filipino of higher taxes for alcohol and cigarettes. It says, “ On the first year of implementation, the government is expected to raise additional revenues worth P60 billion, of which, P30 billion is from cigarettes, P11 from distilled spirits and P19 billion is from beer.”

The more compelling argument is in favor of public health: Data from the Department of Health shows that about 240 Filipinos die daily because of smoking-related diseases, and of the 10 leading causes of mortality, seven are smoking-related.

What is more worrisome is the findings of the 2009 Family Income and Expenditure Survey showing more that more than 76 percent of smokers, 20 years old and above, come from poor families.

Moreover, they spend more on (2.6 percent of their monthly expenditure) on tobacco than education (1.6 percent) and health (1.3 percent.

The Action for Economic Reforms , in their call to lawmakers to pass the bill, when Congress resumes on May 7, cites the evils of smoking as a compelling argument to make tobacco as inaccessible as possible to Filipinos:

“When the diseases precipitated by chronic tobacco consumption finally burst out, it is poor households that are the most at risk. While data disaggregating mortality according to income is elusive, a lauded 2011 study led by Dr. Antonio Dans concluded that death rates from stroke, heart disease, cancer, and chronic obstructive pulmonary diseases (COPD) were highest among low-income populations in the ASEAN region.

“By 2008, up to 220,000 Filipinos may have died annually from tobacco-induced diseases. Yet unbeknownst to most, majority of these victims have come from low-income families. Tobacco-related ailments, Dans and his colleagues have stressed, are not diseases of affluence, but diseases of poverty. Ultimately, this is because smoking prevalence is far higher among the poor in the Philippines and Southeast Asia.

“Even when they are unable to access adequate medical attention, the losses to the poor when a family member is crippled by tobacco use are usually enough to decimate what little savings and socioeconomic prospects they may have. In 2010, reputable sources estimated that the hemorhage to the country and Filipino families’ pockets may have risen to P445.5 billion annually.

“For the lowest 40% of families, the money devoured by medical treatment results in catastrophic expenditures. Data from the Lung Center of the Philippines shows that charity ward treatments alone demand at least P100,000 in outlays for lung cancer patients. Chemotherapy sessions, meanwhile, can cost up to P150,000 each.

“The options available to poor families to cover these expenses are often bleak. Occasionally, families are compelled to assume debts from other relatives, neighbours, loan sharks. They may prematurely halt their childrens’ education, forcing them into informal, underage employment. Others still, when no other source of finance is available, may even hazard their own lives and safety by selling their bodies and body parts in the illicit human trafficking or organ trade industries.

“Ironically, mounting distress usually leads some family members to intensify their consumption of vices like tobacco, jumpstarting a vicious cycle that tears further at the fabric of poor households. When a smoking-induced disease flares up in a poor family— often depriving it of a breadwinner— an uncontrolled spiral into deeper and deeper misery sometimes seems inescapable.”

The manifesto says more revenues that can be generated when HB5727 becomes law will result to higher social and infrastructure spending. “ According to the estimates of the Department of Budget and Management ,the P60 billion can cover about 5.2 million indigent families in premium subsidy, or upgrading of 2,767 public health facilities, including hospitals, or construction of 86,714 DepEd classrooms, or repair of 3,035 kilometers of national roads in bad condition. “

Of course, with his popularity, President Aquino would be a great model if he stopped smoking. But that seems to be mission impossible for health advocates now.

Let’s be content that he is supporting the passage of higher tax of sin products.

Hayaan na natin ang mga ibang kababayan natin sa kanilang mga bisyo, katuwaan lang nila iyun paninigarilyo at pag inom,kung ayaw nating magbisyo sila alisin na rin ang jueting kapag pinatawan ng mas mataas na buwis ang sigarilyo magtanim sila ng maryjuana sa paso.Ganun din sa alak, hindi kayang magbayad ng mga mahihirap sa phyciatrist kapag may depression sila, tataas ang bilang ng suicde.Mga addict na ang iba diyan sa sigarilyo kaya kahit na gaanu kamahal bibili at bibili rin sila, ganun din si Totoy Siokting, nanginginig siya kapag hindi siya nakainom ng cuatro kantos.

Patawan na rin ng sin tax ang soft drinks, french fries and hamburger dahil nagbibigay ng obesity.

I doubt it very much that increasing taxes will reduce consumption of alcohol and tobacco products…in may even have a reverse effect as smuggled goods or selling of “untaxed” products will proliferate the market.

We had tried everything in this part…media campaign as to the ill effects of smoking and excessive alcohol consumption…Not allowing advertisement of Cigarettes and not displaying them in Stores and not selling them to Minors..and Graphic images of its victims on the packages and warnings that it cause Cancer and other Respiratory diseases(Id is required for youth to prove their age) and now they are Taxed to the MAX (to help finance the Health Care for their victims as it cost a lot from diagnosis to treatment to disabilities allowances as there is no limits to its medical care…and the today’s youth still think and believe they are invincible…

There is one Major Battle going on the Quebec Courtroom that will matter in the fight against these Vices…there is Class Action Suit against the Tobacco Companies in the Billions and it is still being heard in Quebec Superior Court…If this one go in favour of the Plaintiffs, then other lawsuits will follow all over the country..and will be followed by each Province Health Ministries to recoup the Billions spent on the victims…the sin taxes can not be used by the Tobacco companies to have been paid to pay for the health care of the victims of their product…

Here is some item that is off the subject but relevant to the ROLE the Media has to play in today society…

http://www.thestar.com/news/investigations/article/706009–the-star-gets-results

Ellen..above is the example of how the media is one of the most effective checks in our society and just today the Toronto Star Investigation score another Big One…

http://www.thestar.com/news/canada/article/1170785–police-who-lie-attorney-general-orders-probe-of-police-deception

It takes a sustained efforts on the team of its investigative reporters to get results..and Today the Province Atty General order a Probe of Police deception and lies in their testimonies to nail their suspects, which they usually took a shortcut to stop and arrest them without respecting the legal rights of the accused and proper police procedures and Lied in the court…and Justices were throwing out serious cases because of Tainted Evidence..and the officers were mostly never disciplined…the Star investigated Gets Results…

Cigarettes are not only harming the ones who smoke. THere is no safe levels of exposure and up to 80% of the exposure may not be detected by the one exposed. I resent the fact that I am continuously exposed to this vice that is the single most preventable cause of death.

And higher taxes would definitely help as cigarette prices in the Philippines are some of the lowest in the world. Those measures mentioned in Canada will be helped by the lawsuit but their prevalence is much lower than the Philippines due to the measures already in place.

And even granting without admitting that it would not work, then the government still gets 60B, that would be nice to use for health promotion, aside from treating the illnesses caused by smoking which currently costs us many many times more than the taxes generated.

Reasoning behind HB5727 is misleading. Cigarettes are addicting and share the biggest pie when it comes to income both for the government and the companies behind it! Majority of smokers are hook simply because they are smoking chemicals not pure tabacco. No amount of price increase will help them quit! Hope the government slows down the money making ventures at the expense of many with nothing in reality to show for it!

Why not look into content of local cigarettes in our country and compare this with other cigarettes sold around the world? Local cigarettes are highly addicting compared to others in my view. Why not regulate instead si that consuming public are actually buying real cigarettes. If increasing the price may be really required there should be certain percent of the profit to educate people about the ill effect of smoking and funding for better medical care.

I don’t think it will finance healthcare or educating smokers, unless they put it in real percent of total in the proposed law!!

taasan nila ang tax sa yosi, eh di si noynoy na la’ang ang maninigarilyo?

bakit hindi na la’ang ganire: bawal manigarilyo pero puwedeng magtabako. mali din ‘ata dahil si fidel ramos naman ang matutuwa nang husto.

aru, joshko! nakakahilo!

“…….It says, “ On the first year of implementation, the government is expected to raise additional revenues worth P60 billion, of which, P30 billion is from cigarettes, P11 from distilled spirits and P19 billion is from beer.”……………”

PhP120 billion revenues during the first year of implementation?

kailan pa ba nagsimula ang pagpapataw ng buwis sa bisyo? di ba’t napakatagal na?

sino ang mga nakinabang? sino ang mga yumaman?

nasaan na sila ngayon?

kailan pa matatapos ang pagpiga sa bulsa ng mga pobre? hindi ko sinasabing huwag nang muling patawan ng panibagong dagdag buwis ang mga ‘yan. kung maaari nga la’ang IPAGBAWAL na ang alak at sigarilyo o anumang uri ng bisyong nakakasira sa kalusugan ng tao o kung hindi man maipagbawal ay i-regulate na la’ang. nasa demokrasya tayo, eh.

ibig ko la’ang sabihin dine, KUNG totoong merong salaping papasok sa kaban ng bayan, DAPAT ay gastusin sa nararapat pagkagastusan katulad ng serbisyo publiko na walang pinipili o pinapaboran.

lalo na, dapat HANDS OFF ang mga namumuno sa pamumudmod ng pondo. DAPAT WALANG POR SIYENTO.

kahit itanong pa ninyo sa pamilya dorobo.

mga damuho!

Musta ka na Pareng Magno?

Dito mo ako mahagilap—https://www.facebook.com/groups/aribawalkthetalk/

pareng cocoy, sa wasak, este sa wakas napansin mo rin ang pagpapakyut ko sa harap mo pero sori, face la’ang ang meron ako. ‘yung book wala pa dahil hindi ko malaman kung saan makakakuha.

welkam bak, agen!

Ang daming batas diyan na pwedi nilang ipasa kung gusto nilang magserbisyo publiko at makatulong sa mga kababayan natin tulad ng gawin na lang libre ang pag-aaral ng mga studyante kahit may 12th grade pa sa High school hangang makatapus sila.

Kinukumusta kita lagi kay Pareng Emil.

ellen, please allow me of this opportunity.

am assigned now in a new project here in jeddah, a high speed rail link project to connect cities of jeddah and makkah for the first phase and eventually, madinah. we will be recruiting (first batch, initially) in manila:

60 steel fixers

60 carpenters

25 masons

05 labours

07 civil engineers

02 surveyors

03 safety officers

kung meron kayong kakilalang kuwalipikado para sa mga nabanggit na posisyon, just advise them send resume at MRivera@almabani.com.sa.

libreng panawagan-tulong ko ito. wala akong por siyento.

Bakit hindi na lang kaya itigil ang pagtatanim ng tabako dito

sa pilipinas?

E kaso pera din ang katapat nyan. Malaki din ang ipinapasok

na pera ng tabako sa kaban ngbayan.

Ok lang ba sa gobyerno na mawala na sa listahan ng buwis ang tabako?

@ 16…alternative crops that could make more returns than Tobacco is Canola if that can be grown instead..but how about Marijuana? it is said to be less harmful than tobacco and now has been proven to be a very effective Pain Reliever…in fact it can be had by Prescription, only that the patients are complaining for the government sanctioned grown crops…not potent enough..I just don’t smoke, otherwise I could get some for my aches and pains instead of these NSAIDs that sometimes or often times cause stomach upsets…

Kahit maging magkano pa ang presyo ng sigarilyo ay bibili pa rin ng bibili ang mahilig mag sigarilyo. Kung tumaas ang presyo ng sigarilyo ang tao na hindi kayang bumili pero gusto ng sigarilyo ay magnanakaw na lang para makapambili ng sigarilyo. Maganda pa rin kung mura ang halaga ng sigarilyo dahil affordable.

Nakapagtataka na dito sa ating bansa ang nakatataas ang gusto lahat ay magtaasan ang presyo ng bilihin samantala ay mahirap ang bansang Pilipinas. Hindi lahat ng nananirahan o tao ay may pera. Parang walang malasakit sa kapwa pinoy ang gusto ng tumaas ang presyo ng mga bilihin na kahit sigarilyo ay gusto pang taasan gayong may mga tao na ang kasiyahan ay nasa paninigarilyo.

Dapat babaan nila ang presyo ng bilihin. Tulad na lang ng mga mangagawa, nagpuputok ang butse nila kay Penoy dahil walang wage increase. Ganun din nag suma niyan, tataas ang sahod tataas din ang mga bilihin, maglalaro lang sa numero. Disadvantage sa mga OFW iyan dahil hindi rin tataas ang sahod nila kahit magkaroon ng wage increase ang mangagawa sa Pinas.Kung minsan nga mas mahal pa ang bilihin diyan kesa presyung America.Kaya kahit na Blikbayan ka at $2,000 ang baon mo it won’t last one month.

instead of imposing massive tax increases na ang mismong tatamaan ay ang mga ordinaryong naghihikahos na mamamayan BAKIT HINDI nila pag-ibayuhin ang tax collection? napakaraming matatabang buwayang tax evaders, ah. diyan nila ibuhos ang kanilang ngitngit upang makalikom ng sapat na buwis.

hilahod na nga ang taong bayan dahil sa walang patlang na pagtaas ng halaga ng mga pangunahing bilihin bunga ng kasibaan ng mga oil companies tapos, taong bayan pa rin ang lubos nilang pinapahirapan sa ginagawa nilang pagtataas ng buwis na ipinapasa ng mga namumuhunan sa mga consumer na hindi na mapagkasya ang karampot na kinikita.

makunsensiya naman kayo!

huwag na tayong manggalaiti sa gustong mangyari ng mga nasa gobyerno dahil marami pa rin naman ang mura sa pilipinas, ah.

Ok yan, mayayaman na lang ang magyoyosi at tsaka yung mga suicidal na ayaw tumigil sa paglunok ng usok.

Fr Toto:

Ang alak at sigarilyo po ay isang bisyo ng isang taong mahirap at mayaman,ng matanda at bata, ng babae o lalaki, kaya kahit anong mahal ng mga bisyo ay hahanapin at hahanapin pa rin, gagawa ng paraan para lang makapag bisyo. Para sa aking opinion, isa batas na ipagbawal na ang mag tinda ng sigarilyo at alak sa mga tindahan sa bahay o sari-sari store, sa mga publikong tindahan,Naisabatas na rin ang pag sigarilyo sa mga publikong lugar at pag inum ng alak sa labas ng bahay, bakit marami pa ring gumagawa?

Dapat isa batas din na-alisin sa langsangan ang nagtitinda ng tingi o per stick. Ang may karapatan lamang na mag tinda ng alak at sigarilyo sa Liqueur store, grocery, at convenient store, na sila ay hindi pweding magtinda ng tingi.

Bakit po? Kasi ang mga bata di naman bibili ng kaha-kahang sigarilyo, ganoon din ang mga simpling Pilipino. Sa aking napapansin ang mga estudyanting high school, meron ding elementary mas pipiliin pa nilang bumili ng sigarilyo kasya ibili ng pagkain . Ako po ay sumusuporta sa may akda ng house bill 5727 na si Cavite Rep. Joseph Emilio Abaya.

Kung bakit tayo inaapi ng Tsina

Bakit nga ba parang sumusobra na ang pang-aaping ginagawa sa atin ng Tsina?

Dahil kaya sa matindi tayong kakampi ng Amerika o baka naman talagang alam na ng Tsina ang ating mga “weak points”?

Hindi ko masasabing tama ako ngunit sa aking pananaw, nawala ang respeto sa bansang Pilipinas ng Tsina noong nakita nila kung anong klaseng tao ang ating dating pangulo noong si Gloria’y tumungo sa Tsina para lamang kumita sa usapan nila tungkol sa ZTE.

Hindi nga ba’t kahit wala naman siyang papel sa pirmahan noong kontrata’y tumungo pa sa Tsina ang ating dating pangulo upang siguruhin lamang na tiyak na napirmahan ang kontrata? Ano ang napansin ng Tsina sa ating mga opisyal?……..

http://www.abante.com.ph/issue/may0512/op_hp.htm

BULL’S EYE!!!

http://arabnews.com/saudiarabia/article625035.ece